Well, it's happened! The market finally matches the weather this July; at this writing both the outside temperatures and the Marin real estate market are in the midst of a summer's heat wave! Read more in this month's Marin Market Update.

Marin Market Update First Quarter 2016

We love the spring selling season. Excitement about new listings, the surprises of what goes into escrow immediately and what sits on the market. What's around the corner, and will there be more? Yes, of course there will, but let’s not count on a huge influx of inventory. Inventory has always been scarce in Marin, so a word of advice… if you're out shopping and you see something you like, grab it!

The topics du jour amongst my colleagues is "are buyers willing to pay more?", “how high will they go?” Or, "have they hit their limit?” The answer to everything, obviously, is "it depends." The under $1 million market is white hot, with 139 properties selling thus far in the first quarter of 2016. We can even say the same about the market up to about $1.5 million. That seems to be the point where buyers become a bit more selective with the “days on market” increasing. Not slow, per se, but buyers are more willing to kick the tires a bit to make sure the value is there and that they're not overpaying.

Fun fact: According to the local MLS, the highest-selling home this quarter in Marin was 20 Glenwood Avenue in Ross, which sold off market for $15,000,000!

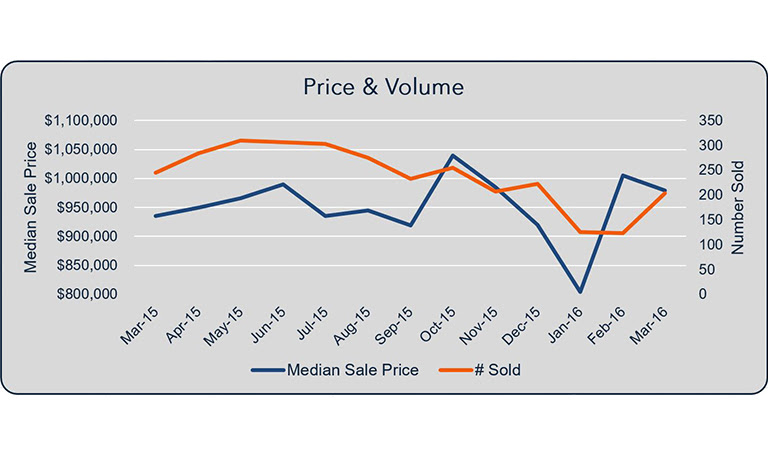

Yes, price increases can be a bit frightening. Any time home prices hit new highs there is a fear that it's all going to come crashing down. But, if you look at historical figures, that's just not the case. Housing prices in Marin have continued to rise over the years, as we can see from the graph below. Sure, we've had dips and surges of activity based on extreme market forces and supply and demand, but invariably housing prices continue to rise. Marin has perhaps increased at a more modest rate than San Francisco and the Peninsula, but still prices have risen. The first quarter of 2016 was no exception.

Single Family Houses Sold in Marin from 1965 to 2015

Overall, the first quarter of 2016 showed a median single family home sales price increase of 9% compared to quarter one of last year – from $1,025,000 to $1,115,000 – while the number of sales declined by 13%.

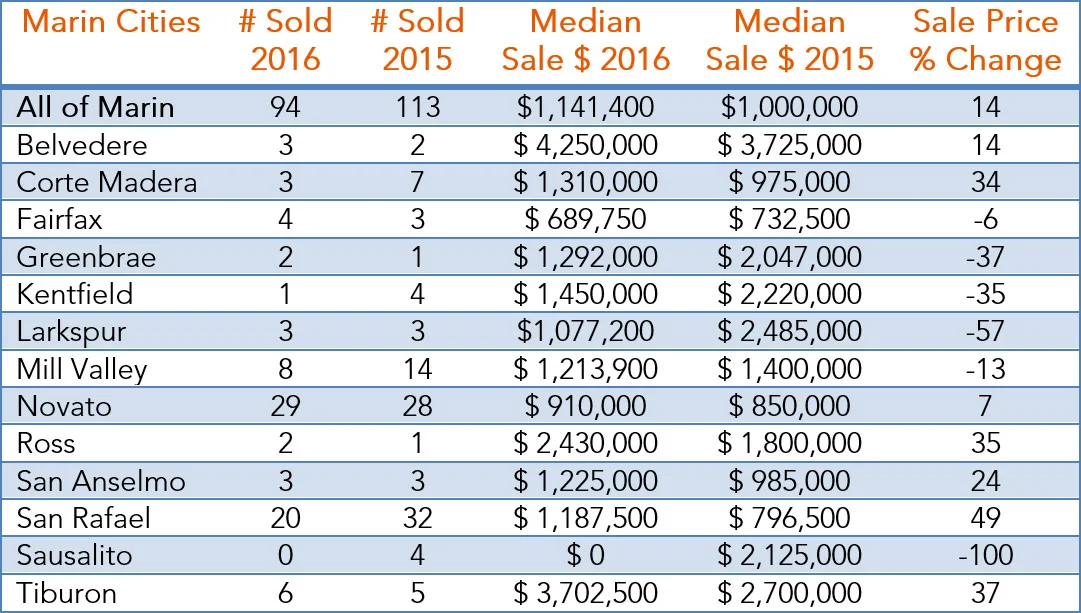

On the other end of the spectrum, single family homes in Belvedere, Fairfax, Greenbrae, San Anselmo, and Stinson Beach have seen median home price appreciation north of 7% quarter-over-quarter. Sausalito had significant price appreciation at 73% though the sample size of homes is still relatively small. Corte Madera’s growth shows a dramatic 29% price increase, but only half the number of homes sold compared with quarter one of last year. San Rafael maintained its large number of homes sold from the previous year’s first quarter, where we see healthy price appreciation at 19%. Novato, on the other hand, sold 90+ homes in the first quarter but price growth only rose 4% compared with the same period last year.

Single Family Houses Sold in First Quarter 2016 vs First Quarter 2015

As of this writing, there are currently 269 single family homes and 75 condominiums on the market in Marin (344 combined). In the first quarter we saw a minor decrease in inventory (383 sold in Q1 2015, versus 335 in 2016) and a 4.5% price increase in homes sold in Marin (single family and condominiums combined).

Marin remains a coveted place to call home with a plethora of financially capable buyers seeking homes. When a property with obvious value hits the market, it's a no-brainer for buyers. When a more complex property comes on – maybe not as many comps, a unique home with unique attributes, etc. – it takes buyers a little longer to ponder. Not a bad thing, they're just taking it all in. Of course, as in any market, overpriced homes won’t garner the same attention, and may continue to sit until they eventually sell for less or they’re taken off the market.

In the luxury market, properties in the $3-5 million range are averaging 100 days on market (twice as long as last year), while properties over $5 million are sitting for half that time. As could be assumed, inventory in the $3-5 million range was markedly less this quarter compared to the first quarter of 2015. However, homes sold over $5 million was at exactly the same number.

Trends of Homes Sold in Marin in Varying Price Ranges

Buyers are getting more judicious in their search, looking for the perfect home. As a result, they are willing to wait for that right home to come on-market before placing any offers.

Last October CAR predicted a more modest overall increase in housing prices for 2016, which has been evident thus far. Can we expect them to stabilize or decrease? Conventional wisdom says yes, because as we've mentioned before this is a cyclical business; there will always be fluctuations. However, buying for the long-term in Marin could never be a more sound investment, especially in the land of Mt. Tam, our beautiful Bay and a quality of life that is unmatched anywhere! According to CoreLogic, San Francisco's housing market may actually be undervalued, so the seemingly high prices in Marin may continue to rise.

The local economy continues to prosper, with recent unemployment figures clocking in at 3.3% for the Bay Area. The Wall Street Journal recently reported that US Venture Funds have collected about $13 billion in the first quarter, the largest total since 2000. It is anticipated that there will be a number of technology IPOs this year, depending on stock market volatility, and that always has a trickle-down effect for Marin and the rest of the Bay Area.

While "all cash" purchases still exist, many buyers want to conserve their cash, meaning more and more buyers are utilizing a mortgage as part of their home purchase offering. We are seeing lots of bridge financing for buyers so they can make a solid offer on a home without first selling the one they live in. Some buyers are also getting hard-money loans for the purchase and then writing "all cash" offers only to refinance once they become owners. They are doing what is necessary to make their offers as competitive as possible and this sometimes includes up-front inspections or even, though not recommended, non-contingent offers (meaning buyers will take the house "as is" without inspections or without thoroughly investigating the property).

If you're thinking about selling your property we recommend getting a pest and even a contractor's inspection ahead of time. Providing buyers with as much information about the house upfront will allow them to place an offer based on the knowledge you've provided without having to guess. It's just a better approach overall than risking a potential non-disclosure issue down the road.

Whether you're buying or selling in Marin County, The Costa Group is here to provide you with expert advice on the best approach to your unique situation.

Marin Market Update-March 2016

They're finally here.

A new crop of homes has hit our inventory-starved County, and Marin Buyers could not be happier. This is the moment we've been waiting for.

Savvy shoppers, who have been watching the market, and are pre-approved and ready to act will reap the benefits of this new Spring harvest. Buyers, if a home pops up in your price range that hits most of your parameters, this agent says go for it! If a home feels right, don’t wait. Write an offer. Too often when a flood of inventory hits the market, buyers get overwhelmed and hesitate, hoping that a more perfect home will come on the market in the coming weeks. But those who hesitate often miss out on a great home, and then find themselves with fewer choices down the road than they had hoped.

Pricing remains critical in this highly charged market. Sellers pricing too high may miss out on a buyer that has dismissed their home as being overpriced. Better to start with a more realistic offer price and let the market determine for how much it should sell.

In Marin, real estate agents, for the most part, try to price as accurately as possible. Sales of comparable homes in one of Marin's many micro-markets that are similar in size, layout and make-up help determine an offer price akin to what the going sales prices are in that area. While there's generally a range that feels comfortable for both buyer and seller, remember that ultimately the market price is the price a buyer is willing to pay.

One of the most common questions we get asked is, “Are we in a bubble? And, if so, when will that bubble burst?” Let’s first burst all this bubble talk. Real estate is a cyclical business. Historically, prices go up and down. Inventory goes up and down. There will always be shifts and swings; that's just the nature of the business. So there will be a downturn again at some point, but since mechanisms have been put in place to guard us from the bubble burst of the past, we expect any market shifts up or down to have little impact over the long term. That’s because for the majority of us, real estate is a more long-term decision: where you want to live to suit your lifestyle, or where you'd like to raise your kids, or where you see yourself building a future, etc. If you are looking to make a move for any of those reasons — or want to make a different kind of investment, real estate continues to be one of the very best places to put your money. I can help you with both.

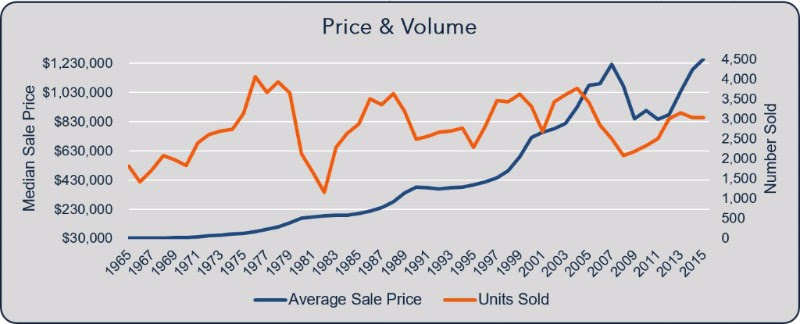

Here’s what happened in Marin Real Estate in the month of February:

Single Family Houses Sold in February 2016 vs February 2015

While fewer properties were sold this February, overall prices did increase in Marin. January and February started off slowly, but look for some solid numbers in March with inventory on the rise. Housing prices are still predicted to rise moderately this year at about 6%, which is a healthy increase, though not as dramatic as in the last few years that saw 10-15% or more appreciation.

The median home price for Marin in February was $1,141,400, up 14% from last year at this same time. For a typical buyer today, purchasing a home at this median price, with a down payment of 20% ($228,280), and a 30-year fixed rate of 3.375%, the monthly mortgage (not including taxes and insurance) would be approximately $4,036.87.

Working with a qualified mortgage professional will help you determine your magic number and what you can afford in the Marin market. Some new loan programs are available, so with good credit you may be able to finance more and pay less down. Rates are still amazingly low, so doing research will help you find the loan package that works best for you.

he majority of properties sold this February in Marin (single family homes and condominiums combined) were under $1 million dollars. In the combined $1.5 million to $5 million price ranges, there was significant increase of days on market, meaning it took longer to sell these homes than it did one year ago. And in the $2-5 million dollar range, while the numbers are small, we did see a slight increase in the number of properties sold.

Of the 60 sold properties under $1M, most of them were in Novato (28) and San Rafael (19). Novato’s under $1M properties were mostly single-family homes, while San Rafael had a majority of condominiums in that range. There were 30 total condominiums sold in Marin this past February with a median sales price of $464,000, versus 49 sold last February 2015 with a median sale price of $505,000.

All in all, we're seeing more normality in the market. Prices are rising, but not at the clip they rose in the past few years. Sales are slower, but we attribute that to low inventory levels and expect to see a significant upward change in the coming months. There are some good values out there right now and more will be coming on the market as we move into Spring. Well-prepared buyers will win by knowing the market, what’s available and having a good sense of recent comparable sales. The key is always to work with a reliable agent as your trusted partner.

OPENING SOON: OUR SECOND OFFICE IN MARIN

We're putting the finishing touches on Vanguard Properties’ new office on Magnolia Avenue in Ross Valley. Look for an invitation in the next few weeks to our Grand Opening event. More details to follow.

Looking to buy or sell a home in Marin County? The Costa Group knows the Marin market well. We'd love to learn more about your real estate needs and share how we can help you make them a reality.

Marin Market Update for February 2016

There was so much anticipation for 2016, “another banner year ahead for real estate!” But, what happened? Not to worry, there's still time for the market to heat up, but man was it dead in January. Not by sheer numbers sake, we did end up selling 126 homes and condominiums in Marin (compared with 115 in January of 2015), but there was just a feeling that nothing was happening. Nothing on the market, nothing to sell, buyers not awake yet from their holiday slumber... what was going on?

Well, maybe it was a bit of a hangover from 2015. Perhaps it was the small interest rate increase by the FED. Maybe it was the stock market scare that had stocks plunging to record drops. Maybe it was the El Nino storms. Who knows? But, rest assured, the heat is back on and the market is just NOW getting going for 2016. Some people say it's "after the Super Bowl" when everything starts happening. This year, and maybe because the Super Bowl is in our own backyard, I'd say that may definitely be true. There's an energy out there – a frenzy descending on the paltry amount of inventory that has shown itself in January. There's an excitement about what's "coming soon" and let me tell you, everybody is ready to go.

Buyers are pre-approved and ready to pounce as soon as they see the home they like (or kind of like). Sellers are still pushing the market, wondering just how far they can take it from a price standpoint. Savvy buyers say “don't take it too far, ‘cause we ain't stupid!"

While mortgage rates are at the lowest they have been in eight months, they will eventually rise, inventory will remain tight, rental rates may also rise making housing feel like a better option, and experts expect slower growth of housing values at about 6% this coming year. We are seeing Gen-X’ers moving into prime wage earning years and enjoying their newly improved financial situation, perhaps new job opportunities, relocation, or even seeking out better neighborhoods for their growing families. In Marin we have the older boomers approaching — or already in — retirement and seeking to downsize or lock in a lower cost of living. Together, these two generations will provide much of the suburban inventory that Millennials will start to acquire. Sellers may finally be ready to put their homes on the market after a few years of equity building, and the realization that with interest rates on the rise, buyers may have less ability to pay top dollar as the year progresses.

There was very little to report as far as stats go this month (only 208 homes in Marin on sale at this writing). Few properties are currently on the market, and some have been sitting for quite some time. Perhaps price is the issue, perhaps there are some hidden defects, or perhaps nobody has come up with the right offer to charm the sellers, but I am happy to show them to you, so call me if you have some interest! Perhaps the sellers will entertain a lower offer, and perhaps this is the diamond in the rough for which you’ve been looking.

Are you looking to buy or sell a home in Marin? Contact us to find out how The Costa Group can help.

Second Vanguard Office Opening in Marin

To meet the incredible demand, Vanguard will open a second office on Magnolia Avenue in Ross Valley across from Rustic Bakery. Watch for doors to open next month!

Marin Market Update November 2015

Overheard in Marin real estate circles...OK, that last one wasn't actually overheard, as most sellers would not admit that they miscalculated the market and didn’t take a professional’s advice, but the others are quite common scenarios in Marin. The stories we're hearing right now are varied -- success stories from buyers and sellers, and stories of extreme frustration.

- “We finally reduced our list price by $100,000 after a month on the market, and immediately got a surge of interest, multiple offers and have just sold at the original asking price!”

- “We went in under asking and got the house… without a counter!”

- “We priced our home low, thinking we'd get multiple offers and we didn't get one!”

- “Despite our agent's suggestion, we listed our house $200,000 over their recommended asking price... no offers. We just accepted an offer below the agent's original suggested price.”

Some properties are flying off the shelves, perhaps because they are well-priced, expertly marketed, in a great location (close to town, transportation, schools, parks, etc.), look great with very little work to be done, or a fixer with tons of potential.

On the other hand, some properties languish on the market. This is ether because the seller is unrealistic about price, the agent has not marketed the property well, the layout is funky, the location is less than desirable, there is too much work to be done, or it is some combination of these factors.

Rest assured, there are eager buyers out there who are ready to make a move... they just want what they want.

As of November 11, 2015, there are 291 active homes on the market in Marin, ranging from $269,000 to $20,000,000. There are also 82 active condos for sale, ranging in price from $120,000 to $2,150,000. Here it is broken-down first by price and then by location:

The further we break it down into location-specific, the numbers dwindle even more. You can see there is a true inventory shortage in all categories. Broken-down by a few select Marin cities, one can see where the opportunities lie (for now):

The average days on market for a single family house this past October is 50, down from the average 58 days on market in October of 2014. This indicates inventory is moving a bit faster than this time last year.

As the economy gains a bit of strength, mortgage rates are beginning to inch up. The Federal interest rates are expected to rise in December and although not directly tied to mortgage interest, they do ultimately affect it. If not raised in December, certainly in the New Year. This is a healthy sign that our economy can stand a little stronger on its own. But, it also has immediate effects on affordability, so will most definitely impact some home prices moving forward.

We are right now in a window of opportunity for buyers and sellers to find that perfect balance of list/buy price. It’s a shame more properties are not on the market. Though the market is pretty healthy, with a solid amount of sales, I think we’d be seeing a lot more movement if we had more properties on the market.

If you are interested in more specifics about your town or neighborhood, please don't hesitate to call us. While the market is varied, there are still ways of determining the true value of your home based on its unique features, recent comps and market conditions. And, if you're in the market to buy, let's strategize about how to make the best purchase for your dollar.

Marin County Market Update | The Costa Group

September 2015

Marin Market Update

A look at how the international economy, mortgage rates, the moods of today's buyers and sellers and local market issues affect Marin Real Estate.

Well, we made it through summer vacations, got everyone back to school, and are ourselves now getting back into the work groove. For those watching the real estate market, we can safely declare that the Fall selling season is upon us. Sellers who’ve been waiting until after Labor Day are poised to put their properties on the market and we expect plenty of increased inventory for Marin County in the coming weeks. Buyers, start your engines!

This past summer 887 homes sold in Marin from June through August as compared with 939 last year. August prices for Marin real estate ranged from $110,250 to $2,175,000 for condominiums – and $390,000 to $47,500,000 (a record setting estate in Belvedere) for single family homes, with a median single family home sale price of $1,085,000 (compared with $960,000 last August).

Who exactly is buying in Marin these days? The spectrum is broad: young families priced out of San Francisco; downsizers who are tired of caring for their large homes; upsizers who are realizing they can get a good price for their current home and find a larger home for their growing family, and; investors who are also looking to cash in on fixers or buyers who are eager to invest in a project. We’re living in a very prosperous time in a very prosperous area. The Bay Area is a global wealth center and that means demand for housing will not be slowing down anytime soon.

The current real estate market is complex. Many are wondering: how long mortgage rates will stay low? Will housing prices start to stabilize or even drop? When will all this happen? The stock market has been volatile. There are questions about the global economy and how that will affect Marin County. Some would-be cash buyers, especially at the higher end, will likely wait and see what happens. But, for many who are thinking about a home purchase with financing, now is a great time to buy.

Sellers, too, need to be aware of the myriad of changing market conditions.

Most economists were predicting the Federal Reserve would start raising rates this fall as the economy shows signs of improvement, but are now talking about a continued easing policy. In other words, low rates should stick around longer.

Low mortgage rates increase affordability. The lower the rates are, the more buyers are willing to spend on a house. Low mortgage rates also drive investors into the housing market since they can leverage their money and earn positive cash flow on rent. Bottom line: low mortgage rates stimulate high housing valuations.

The August jobs report showed unemployment rate falling to a seven year low. With this news, the Fed may announce on September 17 it will begin moving interest rates higher. The only thing that would hold it back is uncertainty about the global economy and the U.S. market volatility. Even so, many believe if there is a rate hike it would be only a quarter percent. The impact to Marin real estate? It might possibly create a sense of urgency with the sellers who feel that any increase in interest rates could mean less buying power and potentially lower prices.

Foreign investors, especially Chinese investors, are very active in high-demand markets in places like New York, London and Sydney, and yes, Silicon Valley, San Francisco and Marin County. Chinese investors looking for alternatives to their country's crashing stock market and the devaluation of their currency now account for 25% of all real estate purchases made by foreigners in the US -- a record high at $29 billion in the 12 months to March 30 according to the National Association of Realtors.

Some of U.S. consumers – those who lost their homes to foreclosures or short-sales during the real estate downturn in 2008 Recession – are also back. It generally takes seven years for a foreclosure to drop off a credit report, and these “boomerang buyers” are reclaiming their credit scores and many are ready to buy. Nearly 700,000 of the 7.3 million homeowners who went through foreclosure or short sales during the bust have the potential to get a mortgage again this year. Experts say these boomerang buyers will be an important segment of the real estate market in the coming years.

And, with equity back, those who were able to make their mortgage payments through the rough economic downturn have been rewarded by rising home prices. Millions are experiencing significant equity increases in their homes, allowing them to sell in this current market and trade up for their next purchase. Overall, that can trigger more homes on the market for first-time buyers.

Renters, too, are thinking now could be a good time to buy. With rental rates skyrocketing in the Bay Area, many renters are realizing that the cost of home ownership is lower than renewing a lease. On average in the second quarter of 2015, homeowners in the U.S. devoted 15% of their income to mortgage, whereas experts say 33% is a comfortable number. Some people living in rentals in the Bay Area devote as much as 50% of their average income on housing.

Demand for Marin real estate in the coming year will also be fueled by the new high speed rail system Smart Train, as well as a continued influx of life sciences and biotech companies into the North Bay. Home values in key areas near the train route and the work centers in San Rafael and Novato are expected to thrive.

Also of interest to Marin home buyers and sellers are continued adoptions by local municipalities to disclose and correct sewer lateral issues prior to the sale of real property. The Marin Association of Realtors has outlined an overall disclosure for consumers to be sure they are complying with local regulations. With all parties aware up front there will be less potential for delays in closings.

Additionally, city inspectors throughout Marin are paying much closer attention to decks and balconies, holding them to higher health/safety standards than in the past, following the recent the deck collapse and fatalities in Berkeley.

For those following the technical aspects of escrows in California, new lending regulations take effect on October 1st and are meant to simplify the reports generated at the end of escrow to clearly show where all proceeds go and to whom. The new forms and disclosures call for ample time to be given for review of files and any changes in the original contract such as credits, accommodations or prices changes. Attorneys who work closely with the National Association of Realtors® have recommended as conservative advice to build into your escrows an extra 15 days for closings. If for example, you had expected a 30 day closing, now plan for a 45-day escrow as a precautionary measure.

So, that's it for the September report. Lots going on, lots to look forward to and lots to observe in this exciting market. We look forward to sharing more with you about Marin Real estate in October.

Please connect with The Costa Group to learn more about home values and current real estate opportunities in Marin County.